Table of Content

- Meet with the claims adjuster

- How to file a homeowners insurance claim

- Can you cash a home insurance claim check?

- What Happens When Multiple Claim Checks Need to Be Issued?

- Property Insurance

- Underrated Add-Ons that Can Take Your Motor-Vehicle Insurance Coverage up A Notch

- Welcome To The Claims Center

- Don't have a GEICO Account?

With just a few clicks you can look up the GEICO Insurance Agency partner your Business Owners Policy is with to find policy service options and contact information. Any entity or person who is a named insured on the policy for the damaged property. Each mortgage company has its own procedure, so be sure and find out from yours how it works. When your claim is finished, you will likely receive a notice that shows the total amount paid and that you accept the claim as closed. In most cases, a single claim should not cause your rate to rise, although certain types of claims — such as one for a dog bite — could quickly result in higher rates.

After a disaster, you want to get back to normal as soon as possible, and your insurance company wants that too! You may get multiple checks from your insurer as you make temporary repairs, permanent repairs and replace damaged belongings. If your home has recently experienced a fire, flood or burglary, you will want to file a claim with your homeowners insurance company. Once your insurer has approved your claim, you will be sent a claim check to repair the damage. According to the Insurance Information Institute, most states require that you make home insurance claims within one year of your loss.

Meet with the claims adjuster

Be sure you have open communication with everyone on your policy. The insurance company is going to send a claims adjuster to make estimates of the cost of the damage. Having your own numbers established will give you a point of reference with which to judge those estimates. Your provider will send you a new declaration each time you renew your policy, so you always have up-to-date information about your coverage.

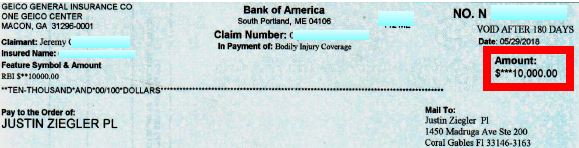

They tend to collect this information on a per-property basis, and are used by your homeowners insurance when calculating premiums, or whether or not to continue an insurance contract. It depends on who the check is made out to, if it is made out to you alone, you can absolutely cash it. However, if you have a mortgage on your home in most cases the check will be made out to both you and the mortgage lender which means they must sign off before the check can be cashed. This is to ensure that you have the repairs to the house made and not just simply cash the check and pocket the cash. Your mortgage lender will want to ensure that their investment in your home is protected by making sure it is properly repaired.

How to file a homeowners insurance claim

Once the adjuster has finished investigating, they will calculate an estimate of how much you should be paid to repair the damage. You’ll receive an official notice of the claim settlement amount in writing. If you file a single claim, your rates generally should not increase. However, filing multiple claims in a short period can result in a rate hike. All things considered, this small increase can pay you back 10-fold in the event you file a zero-dep claim. Helpful bicycle insurance agents, who can assist you in servicing your policy, are just a phone call away.

If you own an expensive vehicle or are an inexperienced driver, this add-on will be highly beneficial for you. The percentage of Depreciation calculated based on the age of the vehicle has been elaborated below. All vehicles undergo wear and tear over time, and as a result of this, the value of the vehicle also drops.

Can you cash a home insurance claim check?

The above add-ons make sure that you do not have to suffer any losses, even in the worst of situations. ACKO has great motor-vehicle insurance plans and all of the add-ons mentioned above to go along with them at very affordable rates. With this add-on as a part of your motor vehicle insurance policy, you will be compensated for the value of the vehicle as mentioned in the invoice of the vehicle. The more expensive your vehicle is, the higher the benefits of adding this to your motor vehicle insurance policy. You can completely eliminate these losses in your insurance coverage by going in for a Zero-Depreciation add-on.

Making this a yearly routine can ensure that you keep your premiums as low as possible. If your insurer approves your claim, you will receive a check or payment via direct deposit. If it is a major claim that requires lots of rebuilding your payment may be sent out in installments as the work is completed. In other cases, your insurer may send out an advance check against the final settlement amount to give you some funds while waiting for the claim to be completed. It is also possible that you will receive separate checks for the structure of your home and your personal possessions. Depending on the severity of the damage and your insurance company, a claims adjuster may be sent out to inspect the damage.

In some cases, your lender may put the money from your insurance provider in an escrow account. In this situation, your lender will pay for work as it’s completed. You’ll likely need to show your mortgage lender your contractor’s bid in order to get upfront funds, and your lender may wish to inspect your home before making the final payment to the contractor.

When your claim is completed, you will most likely be required to sign a notification indicating the total amount paid. According to this document, the claim will be concluded, and you will accept the final claim payment. Keep track of your claims checks and expenses until your last claim payment is made until you come to that point. To be qualified to lodge a claim, each insurance provider will have a deadline by which you must notify them of your loss. Make sure to inquire about this with your insurance claims adjuster. CLUE reports contain all kinds of information, including your name, address, the name of your insurance company, and the type of policy you have, as well as a report number.

A claims adjuster may need to visit your home to inspect the damage. You may complete a "proof of loss" form at this time, which is a formal statement about the loss. Your insurer will either approve or deny your claim based on the adjuster’s evaluation and your documentation. Keep in mind that you might need to send additional evidence if your insurer denies your claim. You can also hire a public adjuster or an insurance attorney to help prove the legitimacy of your claim. Comprehensive insurance policies are definitely a step up from third-party insurance, but it still does not cover everything.

You may need to hire an attorney if you still don’t understand why your claim was denied after speaking with a representative. An attorney who specializes in insurance claims can help you navigate the appeals process and potentially get your claim paid. Homeowners insurance protects you from financial loss in the event of damage to your home or possessions. However, filing a claim can be lengthy and complicated, and it’s important to ensure that you have a valid claim before proceeding.

Following a step-by-step procedure for filing a claim is the best way to make sure your claim is successful and is processed quickly. The RTI add-on is only applicable to vehicles that are less than 5 years old. One point to note is that this add-on is not available for vehicles that are more than five years old.

Login for quick access to your previous policy, where all of your vehicle information is saved. Access your policy online to pay a bill, make a change, or just get some information. Check on repair progress regularly and arrange to be present when your lender inspects the work. If issues are identified, agree on an approach and timeline for their resolution, then attend any subsequent inspections.

No comments:

Post a Comment